The average U.S. life insurance policy pays $189,000 to beneficiaries within 30-60 days of filing a claim, but your payout depends on your specific policy’s benefit and chosen payout method.

Written by Anthony MartinFact Checked by Jeff Root & David Duford

Anthony Martin is a nationally licensed insurance expert with over ten years of experience and has personally served over 10,000 clients with their life insurance needs. He frequently authors entrepreneurial and life insurance content for Forbes, Inc.com, Newsweek, Kiplinger, and Entreprenuer.com. Anthony has been consulted as an expert life insurance source for dozens of high-profile websites such as Forbes, Bankrate, Reuters, Fox Business, CNBC, Investopedia, Insurance.com, Yahoo Finance, and many more.

Jeff Root is a nationally licensed life insurance expert with over 15 years of experience. He has personally helped over 3000 clients with their life insurance needs. Jeff is a best-selling Amazon author and the managing partner of a highly successful insurance brokerage that manages over 2,500 licensed insurance agents across the USA. He has been a featured life insurance source for prestigious websites such as Forbes, Bloomberg, MarketWatch, Nerdwallet, and many more.

David Duford is a nationally licensed insurance expert with over ten years of experience. He has personally helped more than 1500 clients buy life insurance. David has been featured as an expert source for highly authoritative publications such as A.M. Best and Insurancenewsnet. He also runs one of the largest Youtube channels to help aspiring insurance agents serve their clients better.

Fact CheckedThis article has been thoroughly reviewed by the author and third-party life insurance experts to ensure it adheres to our quality standards for accurate and honest advice.

Updated 10-24-23 2 minute read Updated on October 24, 2023 2 minute readAs a licensed insurance agency, Choice Mutual is committed to integrity in our editorial standards and transparency in how we receive compensation from our insurance partners.

Editorial DisclosureOur mission is to provide credible content written and fact-checked by verifiable experts to educate consumers like yourself. All content is regularly updated and reviewed to ensure the highest degree of accuracy. We do earn a commission from the sale of insurance products seen on this website. That said, our evaluations, commentary, opinions, and recommendations are not influenced by monetary gain. We always suggest what’s best for each customer rather than what makes us the most money.

Compensation DisclosureAs an independent insurance agency, Choice Mutual gets paid a commission from our insurance partners every time we sell a policy. Without us, the insurance companies would not have a customer. Your policy does not cost more because we helped you, and our advisory services cost you nothing. The exact amount we get paid for each sale varies depending on the applicant’s age, health, and the specific product applied for. We never recommend products based on which one pays us the most. We suggest products based on the needs and desires of the applicant. It’s also worth noting that we pay our sales agents a salary rather than on a commission-only basis. Choice Mutual does not earn money via selling sales leads or data to third parties, referring users to other websites, displaying ads on our website, or other means.

Learn more about how we make money and other FAQs.

Licensing DisclosureChoice Mutual is a licensed insurance agency authorized to sell insurance in all 50 U.S. states, including D.C. You can verify our license and lines of authority on our licenses page.

Whether you’re trying to choose the right life insurance policy or you’re a beneficiary of an existing policy, it’s valuable to know the average life insurance payout you might expect in the U.S.

Here’s what beneficiaries can expect on average:

How much you or your family will receive depends on your policy and other factors, like if you borrowed against the policy while living.

Learn more about life insurance policies, tips to file, and what will impact your policy payout below.

Life insurance is purchased to provide a cash payout at the time of the policyholder’s death. The policy provides payout, called a death benefit, to the beneficiaries named in the policy or the policyholder’s heirs to provide financial support and stability after death.

The benefit can pay for funeral arrangements, debt, or any other expenses the beneficiaries choose to spend it on.

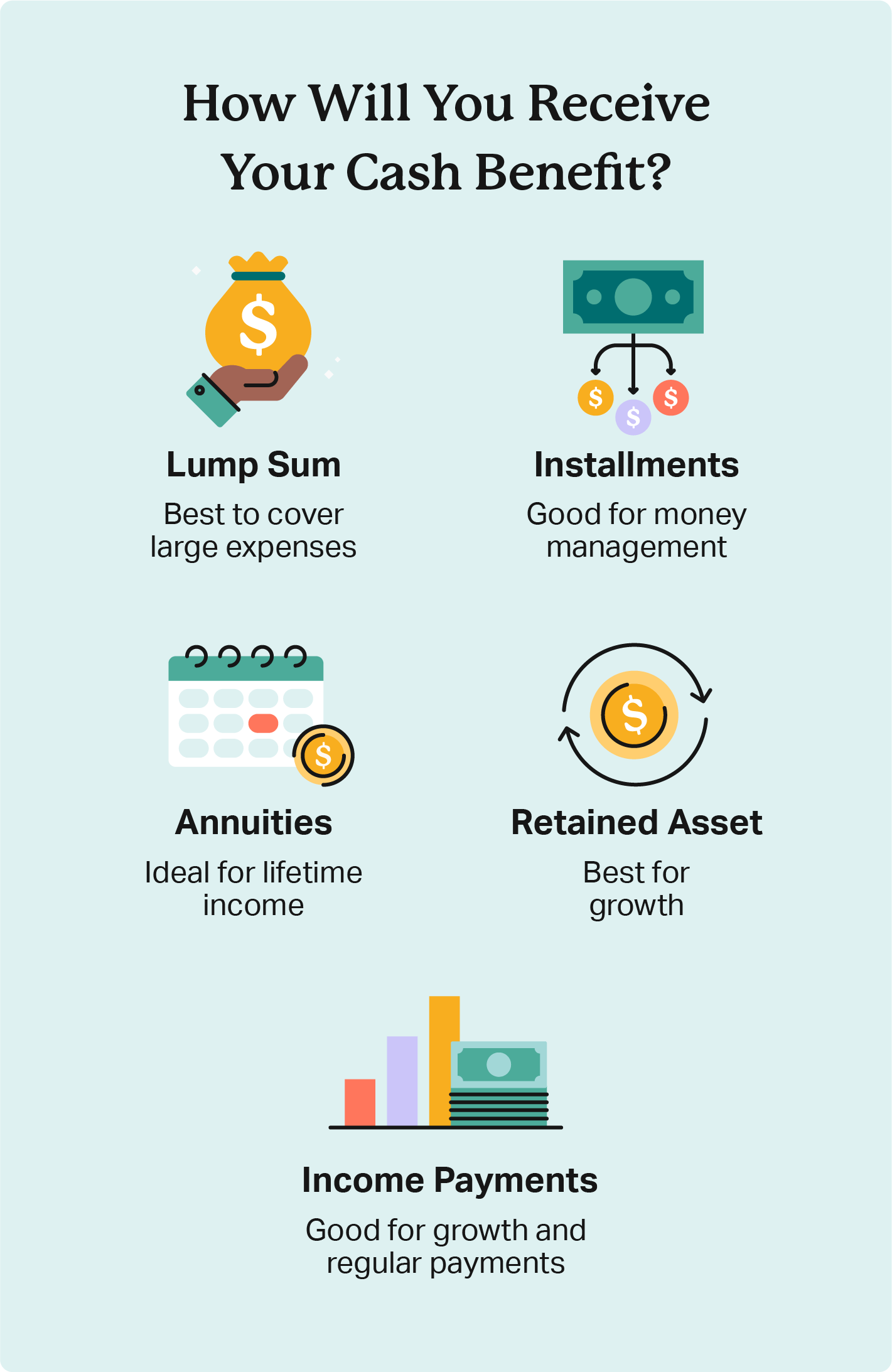

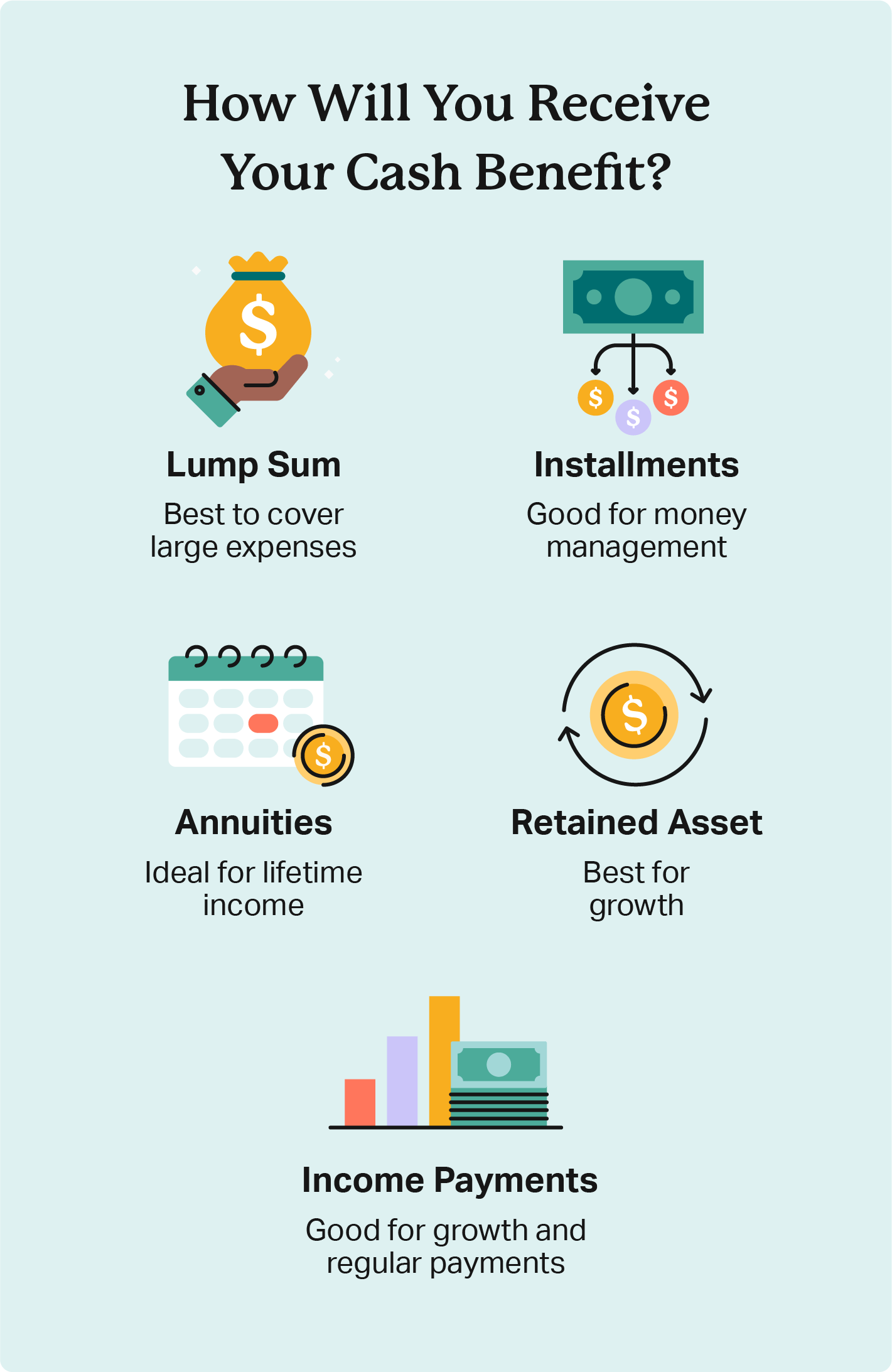

Beneficiaries submit a claim to the life insurance company once they confirm a policy is active. Most policies pay out with a lump sum, but other options may be available to you.

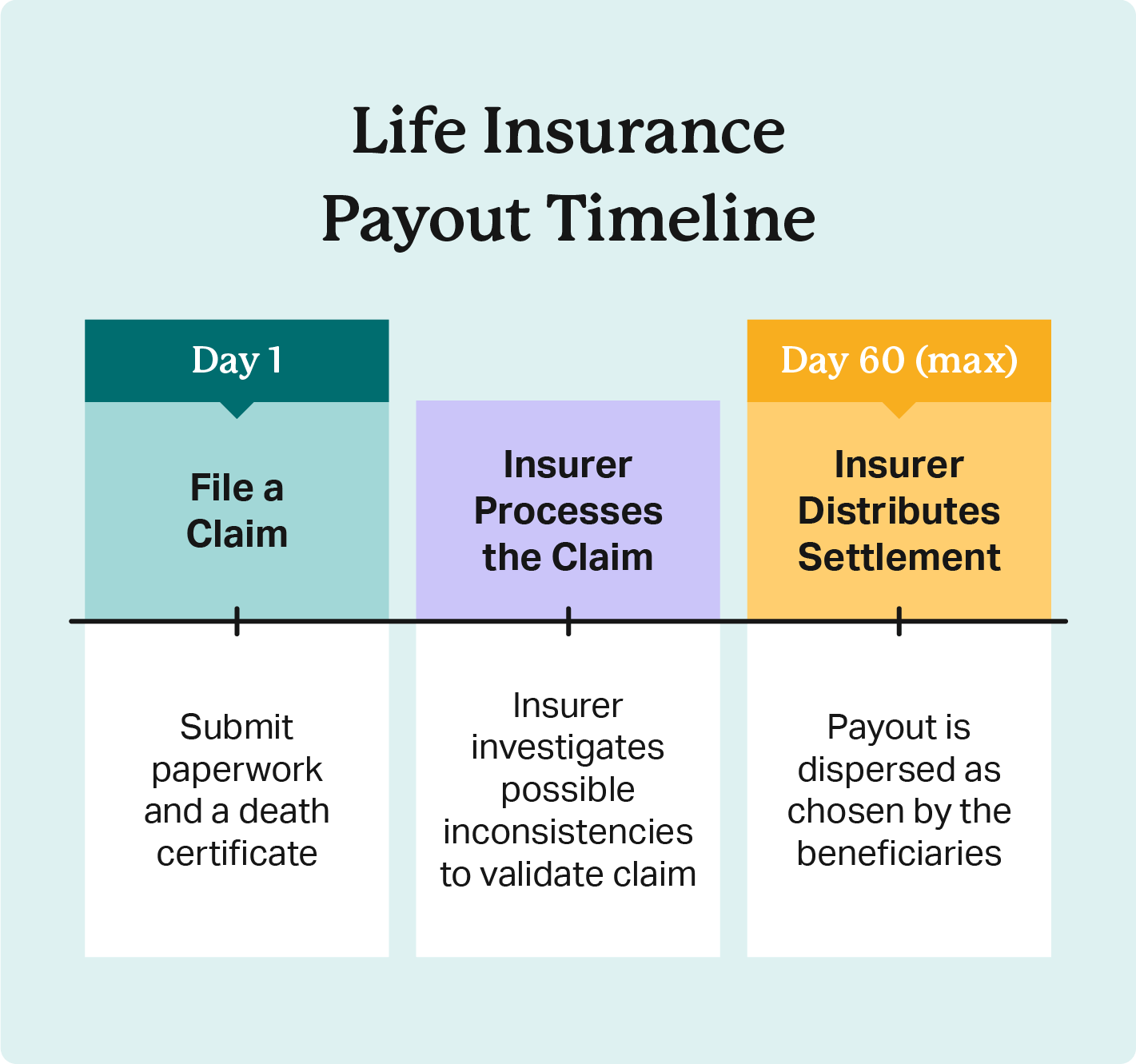

Insurers typically pay out within 30-60 days after they receive a valid claim. There isn’t a time limit to file your claim after the policyholder’s death, but the longer you wait, the longer your payout will take.

You can file a claim as soon as you have a certified death certificate copy. The process is simple:

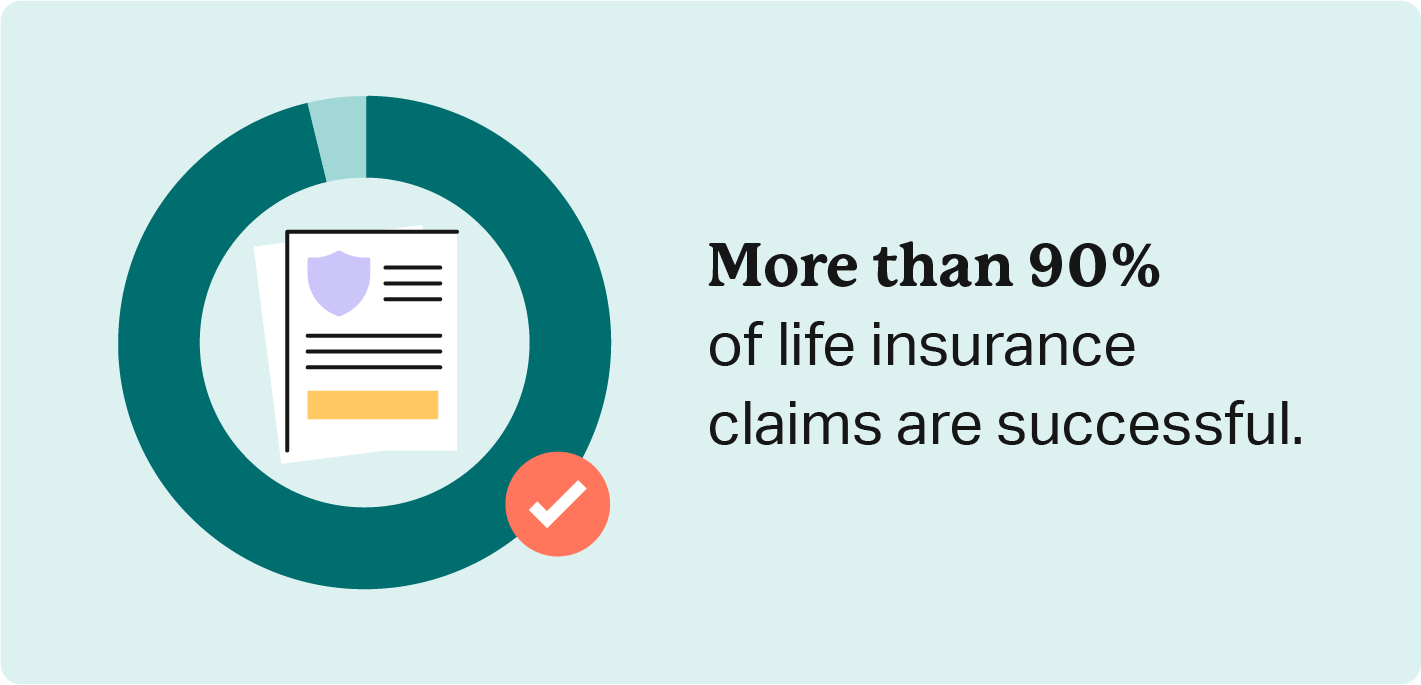

Submitting a claim is straightforward, and most life insurance claims are approved.

However, there are some factors that can delay or invalidate your settlement.

A delay in filing your claim is most likely to stall your payout, but several other issues can impact claim processing and payment.

Life insurance supports families in the event of the policyholder’s death with a cash benefit to cover final expenses or debt or provide financial security for their loved ones. Understanding the average life insurance payout and timeline can help you determine how much coverage you need.

Want to learn more? Explore quotes to compare life insurance prices and coverage among America’s most trusted providers.

Table Of Contents

Use the fields below to post a question directly to our forum and get answers from verified experts and fellow consumers. You can also visit the forum to explore all final expense insurance discussions — or maybe answer a question yourself.

Learn how final expense insurance plans for seniors work, the cost, and how to find the best burial insurance for seniors with no.

A breakdown of all the pros and cons of final expense life insurance and if it's worth buying this type of coverage.

How to buy burial insurance for parents, including the requirements, cost, and tips for finding the best policy.

![]()

Choice Mutual® is an insurance agency that sells insurance in all 50 US states, including DC. The information on this site is for educational purposes, and insurance quotes are non-binding. While we have done our best to ensure all rates shown are accurate, human error is possible. In the rare event of a pricing mistake, the insurance company’s rates will always supersede whatever price appears on our website.

Not all products are available in all states. Product eligibility for each carrier varies depending on the following factors: resident state of the insured, age, and medical underwriting restrictions. All plans with no waiting period require an applicant to be medically approved and are subject to the incontestability period. All guaranteed acceptance plans with no health questions will be subject to the insurer’s defined waiting period before benefits become payable under the policy provisions.

Any of the following insurance companies may underwrite coverage available through Choice Mutual: Accendo Life Insurance Company (Aetna), Aflac, AIG, American Amicable, American Home Life, Americo, Baltimore Life, Columbian Financial Group, Continental Life Insurance Company (Aetna), CICA Life, Foresters Financial, Gerber Life, Great Western, Guarantee Trust Life, Liberty Bankers Life, Mutual of Omaha (United of Omaha), Prosperity Life Group, Royal Neighbors of America, or Transamerica.

Under no circumstances will Choice Mutual share or sell your information with a third party without your consent.

No part of this website may be copied, published, faxed, mailed, or distributed in any manner without prior written consent from the website owner.

© Copyright 2024, Choice Mutual®. All Rights Reserved.

Leave a Message

We’re always happy to offer our guidance.

Fill our the form and we’ll contact you shortly.

By pressing "Submit" you agree to our privacy policy and consent to have a Choice Mutual agent contact you by email, phone call, text/SMS message at the phone number and email you provide. Consent isn’t a condition to purchase our products.